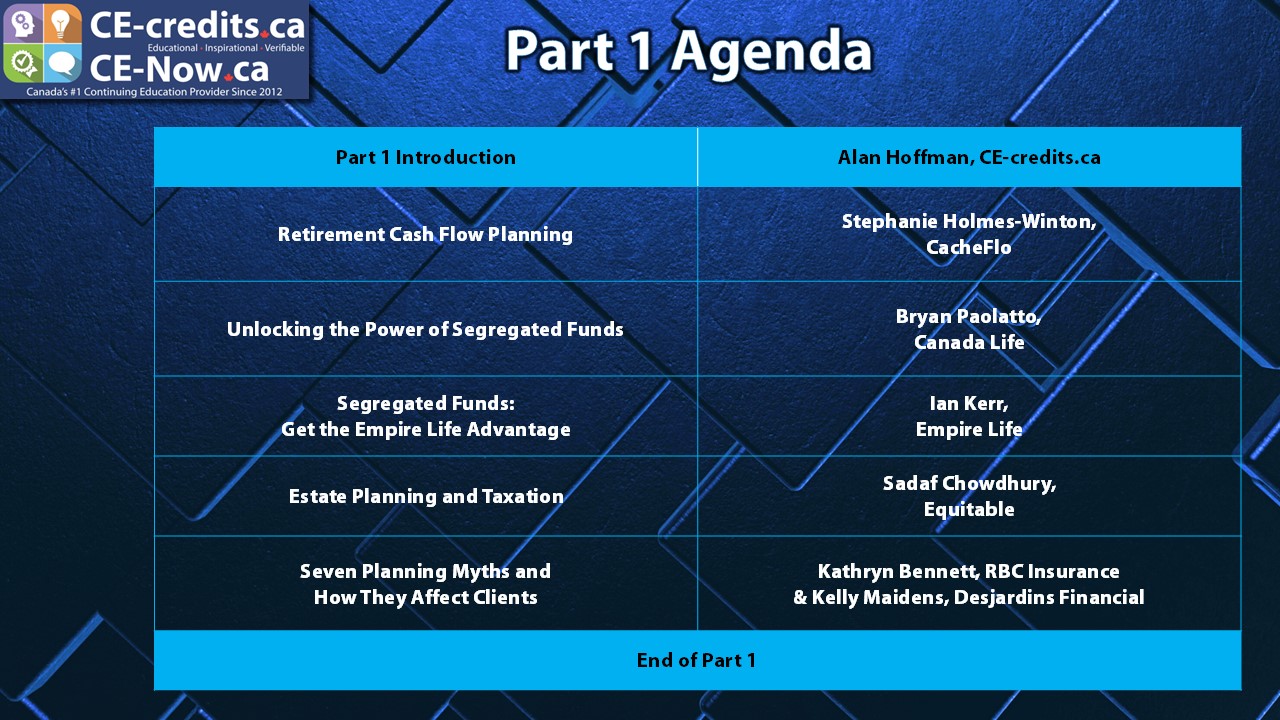

Theme Pack Agenda - Part 1:

Want to learn more about this Theme Pack? Check out Part 1 of the agenda! Combined presentation time: 5h

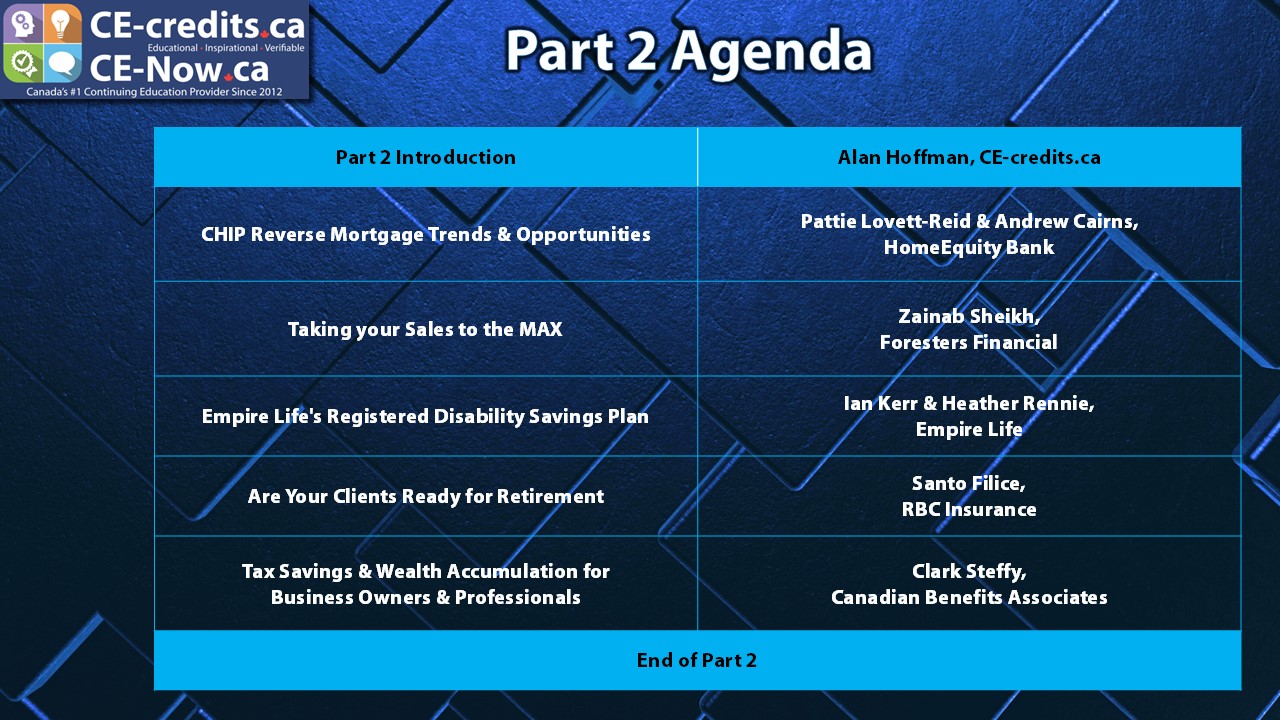

Theme Pack Agenda - Part 2:

Check out Part 2 of the agenda! Combined presentation time: 5h

How to Earn Your CE Credits?

This is a simple 3 step process 1. Watch all 10 presentation videos 2. Complete all parts of the curriculum (listed below) 3. Click the Complete Course button at the end. Good news for you, is that there are no quizzes!

CE Credits provided by this Theme Pack:

* FP Canada - 4 Financial & 6 General Planning credits * Advocis - 10 IAFE Approved credits * MFDA - 6 Professional Development & 1 Business Conduct credits * CSI - 6 Professional Development & 1 Compliance credits * FSRA - 10 FSRA Approved credits * ICS - 5 Life Insurance & 5 Segregated Funds credits * ICM - 5 Life Insurance & 5 Segregated Funds credits & acceptable to many other organizations.

Curriculum

-

1

2025 Retirement Planning Theme Pack - 10 Credits

-

(Included in full purchase)

Retirement Planning Theme Pack Overview

-

(Included in full purchase)

The Rules Governing CE Credits

-

(Included in full purchase)

Welcome to Part 1

-

(Included in full purchase)

-

2

1 - Retirement Cash Flow Planning, Stephanie Holmes-Winton, CacheFlo

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

3

2 - Unlocking the Power of Segregated Funds, Bryan Paolatto, Canada Life

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

4

3 - Segregated Funds: Get the Empire Life Advantage, Ian Kerr, Empire Life

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

5

4 - Estate Planning and Taxation, Sadaf Chowdhury, Equitable

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

6

5 - Seven Planning Myths and How They Affect Clients, Kathryn Bennett, RBC Insurance & Kelly Maidens, Desjardins Financial

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

Break Time

-

(Included in full purchase)

-

7

Welcome to Part 2

-

(Included in full purchase)

Welcome to Part 2

-

(Included in full purchase)

-

8

6 - CHIP Reverse Mortgage Trends & Opportunities, Pattie Lovett-Reid & Andrew Cairns, HomeEquity Bank

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

9

7 - Taking your Sales to the MAX, Zainab Sheikh, Foresters Financial

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

10

8 - Empire Life's Registered Disability Savings Plan (RDSP), Ian Kerr & Heather Rennie, Empire Life

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

11

9 - Are Your Clients Ready for Retirement?, Santo Filice, RBC Insurance

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

12

10 - Tax Savings & Wealth Accumulation for Business Owners & Professionals, Clark Steffy, Canadian Benefits Associates

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

13

Congratulations

-

(Included in full purchase)

Congratulations

-

(Included in full purchase)

About your MC: Alan Hoffman

Alan began his career in 1996 as a Financial Advisor with London Life. Since 2012, Alan Hoffman and CE-credits.ca has been working to create Continuing Education that actually provides Canada’s Financial Advising community with content that is truly relevant and useful within their practices. Through CE-credits.ca, they provide advisors with easy on demand access to earn their CE Credits the way they prefer, through webcasts, bundles, theme packs, and a library of over 500 presentations to learn from. Today, CE-credits.ca is the #1 CE Provider in Canada.

2025 Retirement Planning Theme Pack - 10 CE Credits

Enhance your investment expertise! Join the Retirement Planning theme pack to help clients make informed decisions. Earn CE Credits easily—just watch, no quizzes! Click “Start Theme Pack Now” to get started!

$175.00